Planning

Transportation Planning

Staff supports the Transportation Advisory Committee and works in partnership with the Missouri Department of Transportation to identify needs and evaluate needs and projects for the region. Additional information…

Ordinance Codification

Through a separate contract, MRPC can organize, computerize, index and cross reference a city’s ordinances and present them in a three-ring binder for easy access. MRPC also offers an update service that meets the city’s needs.

Comprehensive, Strategic Planning and Surveys

MRPC assists communities with the development of these plans using citizen focus groups and surveys. MRPC also assists with community needs assessments and surveys as well as housing assessments.

Traffic Counter Programs

With purchase of three traffic counters, MRPC can assist local entities with traffic volume counts and / or classification as needed.

Revolving Loan Fund Program

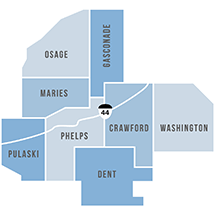

MRPC prepares applications and services RLF loans for customers in the eight-county area. This local fund was created by a grant from the Economic Development Administration with local match provided by cities, counties, businesses and other organizations. Additional funds were recently added through a loan from USDA’s Intermediary Relending Program. (IRP) MRPC is the grantee for the RLF fund and the borrower for the IRP fund. MRPC contracts with the Meramec Regional Development Corp. to manage the RLF and IRP portfolio, to ensure loan processing and servicing and to comply with EDA regulations. These are usually participation loans with a local bank, and its purpose is to create or retain jobs. The RLF may offer a lower interest rate than most commercial institutions. All decisions are made by the Meramec Regional Development Corporation, a local not-for-profit loan board appointed by presiding commissioners and the MRPC board. In turn, MRPC contracts with MRDC to staff the loan program.

Mapping & GIS

MRPC has staff trained in the use of ARCView, a GIS mapping software program, and are able to produce maps and databases for specific projects for a fee.

501 (c) 3 Preparation

Staff assist nonprofits in filing the necessary paperwork to secure a IRS 501 (c) 3 nonprofit designation. Staff can also help troubleshoot problem applications.

Program Administration

MRPC contracts with organizations to provide staff to support the organization. Acting on behalf of the organization, staff can plan meetings, prepare agendas and minutes and handle day-to-day activities and serves as the organization’s office.