Chapter 17

Chapter 17

TAXATION

CONTENTS

ARTICLE I. IN GENERAL

§ 17-1. Abstract to be procured.

§ 17-2. Board to set rate of taxation.

§ 17-3. Property liable for taxes.

§ 17-4. City may sue on tax bills.

§ 17-5. Settlements to be entered on record.

§ 17-6. Tax levy for general revenue.

§ 17-7. Settlement agreement with Verizon Wireless..

§ 17-8. Settlement agreement with US Cellular.

§ 17-9. Settlement agreement with AT&T Mobility.

§ 17-10. Settlement agreement with Sprint.

ARTICLE II. MOTOR VEHICLE TAX

§ 17-11. Definitions.

§ 17-12. License required.

§ 17-13. License fees.

§ 17-14. Term of license – License fee pro-rated.

§ 17-15. Collector to issue license.

§ 17-16. Display of license.

§ 17-17. License not transferable.

§ 17-18. Duplicate license.

§ 17-19. Penalty.

§§ 17-20 to 17-24. Reserved.

ARTICLE III. SALES TAX

§ 17-25. City sales tax.

§ 17-26. Sales tax on residential utilities.

§ 17-27. Tax rate.

§ 17-28. Clerk to provide copy of ordinance to utilities.

§§ 17-29 to 17-33. Reserved.

ARTICLE IV. SALES TAX FOR TRANSPORTATION PURPOSES

§ 17-34. Imposition of city sales tax.

§ 17-35. Ordinance submitted to voters.

§ 17-36. Clerk to certify election results to director of revenue.

§ 17-37. Severability.

§§ 17-38 to 17-42. Reserved.

ARTICLE V. LOCAL USE TAX

§ 17-43. Local use tax imposed.

§ 17-44. Local use tax based on local sales tax.

§ 17-45. Use tax return.

§ 17-46. Clerk to certify ordinance to director of revenue.

§§ 17-47 to 17-51. Reserved.

ARTICLE VI. SALES TAX FOR PUBLIC SAFETY

§17-52. City Sales Tax for Public Safety.

ARTICLE VII. Tax Levy for Road District #8

§ 17-53. Tax levy for road district #8.

Chapter 17

TAXATION

ARTICLE I

IN GENERAL

Sec. 17-1. Abstract to be procured.

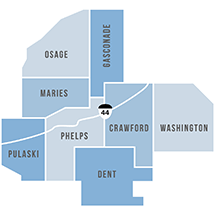

The mayor shall procure from the county clerk of Maries County, on or before the 1st day of July of each year, a certified abstract from his assessment books on all property within the City of Vienna made taxable by law for state purposes, and the assessed value thereof as agreed upon by the board of equalization, which abstract shall be immediately transmitted to the board of aldermen, and said board of aldermen before making said levy as in this Chapter provided, shall examine, and, if correct, approve and accept said abstract and if incorrect said board of aldermen shall cause the same to be corrected before accepting and approving the same for tax purposes. The city shall pay said county clerk for said abstract such compensation as may be allowed by law. (§331.007, 1978 Code)

Sec. 17-2. Board to set rate of taxation.

The board of aldermen shall, from time to time, provide by ordinance for the levy and collection of all taxes, licenses and other debts due the city and for the neglect and refusal to pay the same, shall fix such penalties as are now or may hereafter be authorized by the Statutes of Missouri and the ordinances of the City of Vienna, and the board of aldermen shall, at its regular meeting to be held on the first Tuesday in July of each year, establish by ordinance, the rate of taxes for the ensuing fiscal year. Should the board of aldermen for any reason fail to meet, or should no quorum be present at said meeting to be held on the first Tuesday in July, then it shall be the duty of the mayor to forthwith convene said board in special session for the purpose of establishing the rate of taxes for the ensuing year. (§331.009, 1978 Code)

Sec. 17-3. Property liable for taxes.

Every person owning or holding property on the 1st day of January, including all such property purchased on that day, shall be liable for the taxes thereon for the ensuing year, and a lien is hereby created in favor of the City of Vienna against any lot or lots or tract of land for any such tract assessed by said city against the same, which said lien shall be superior to all other liens or encumbrances except the lien of the state for state, county or school taxes. (§331.015, 1978 Code)

Sec. 17-4. City may sue on tax bills.

All special tax bills issued for special assessments for paving, macadamizing, curbing, guttering, excavation, grading, construction of sidewalks and for sewer districts and for any other purpose whatever authorized by ordinance and the laws of the State of Missouri shall be assignable and collectable in any action brought in the name of the city and to the use of the holder thereof; but the city shall not in any event be liable for any costs that may accrue in such action. Such special tax bills shall, in any action thereon, be prima facie evidence of the regularity of the proceedings for such special assessment, of the validity of the bill, of the doing of the work and of the furnishing of the materials charged for, and of the liability of the property to the charge stated in the bill. (§331.023, 1978 Code)

Sec. 17-5. Settlements to be entered on record.

The board of aldermen shall cause all settlements made with the city officers handling city funds to be entered on record. (§331.131, 1978 Code)

Sec. 17-6. Tax levy for general revenue.*

A General Revenue tax levy of 0.6506 on one hundred dollars valuation shall be assessed on all real property and all personal property within the corporate limits of the City of Vienna, Missouri, for the taxable year of 2023. (Ord. 113, §1; Ord. 119, §1; Ord. 126, §1; Ord. 133, §1; Ord. 143, §1; Ord. 153, §1; Ord. 162, §1; Ord. 177, §1; Ord. 181, §1; Ord. 185, §1; Ord. 190, §1; Ord. 198, §1; Ord. 202, §1; Ord. 205, §1; Ord. 209, §1; Ord. 212, §1; Ord. 221, §1; Ord. 228, §1; Ord. 230, §1)

*RSMo 67.110 – Fixing the annual rate of levy for the real estate and personal property taxes

Sec. 17-7. Approving a settlement agreement with Verizon Wireless.

(a) The City of Vienna, Missouri hereby approves, accepts, and adopts all terms and provisions of the Settlement Agreement as a binding and enforceable agreement between the City of Vienna, Missouri and Verizon Wireless, and as if the City of Vienna, Missouri was an original signatory thereto.

(b) The City of Vienna, Missouri further approves the Total Past Tax Consideration of $2,955.95 as shown on the Verizon Wireless Municipal Tax Settlement Claim Form, along with the other relief provided in the Settlement Agreement, as adequate consideration for the release of claims by the City of Vienna, Missouri against Verizon Wireless as provided for in the Settlement Agreement.

(c) The City of Vienna, Missouri further assigns to the Missouri Municipal League $147.80 of its Total Past Tax Consideration, which amount shall be used for the public purpose of reimbursing the League for revenues expended in its legislative and settlement efforts relating to the Lawsuit and to fund future services performed on behalf of the League’s member municipalities

(d) The Mayor of the City of Vienna, Missouri, on behalf of the Plaintiff, is hereby authorized and directed to execute the Verizon Wireless Municipal Tax Settlement Claim Form and any other documents necessary under the Settlement Agreement.

(e) The City of Vienna, Missouri, reserves the right to conclude settlement agreements with other wireless telecommunications service providers in the Lawsuit depending upon the circumstances of each case. (Ord. 154, §§1-4)

Sec. 17-8. Approving a settlement agreement with US. Cellular.

(a) The City of Vienna, Missouri hereby approves, accepts, and adopts all terms and provisions of the Settlement Agreement as a binding and enforceable agreement between the City of Vienna, Missouri and U.S. Cellular, and as if the City of Vienna, Missouri was an original signatory thereto.

(b) The City of Vienna, Missouri further approves the Total Past Tax Consideration of $84.79 as shown on the U.S. Cellular Municipal Tax Settlement Claim Form, along with the other relief provided in the Settlement Agreement, as adequate consideration for the release of claims by the City of Vienna, Missouri against U.S. Cellular as provided for in the Settlement Agreement.

(c) The City of Vienna, Missouri further assigns to the Mo. Municipal League $4.23 of its Total Past Tax Consideration, which amount shall be used for the public purpose of reimbursing the League for revenues expended in its legislative and settlement efforts relating to the Lawsuit and to fund future services performed on behalf of the League’s member municipalities.

(d) The Mayor of the City of Vienna, Missouri, on behalf of the Plaintiff, is hereby authorized and directed to execute the U.S. Cellular Municipal Tax Settlement Claim Form and any other documents necessary under the Settlement Agreement.

(e) The City of Vienna, Missouri, reserves the right to conclude settlement agreements with other wireless telecommunications service providers in the Lawsuit depending upon the circumstances of each case. (Ord. 155, §§1-4)

Sec. 17-9. Approving a settlement agreement with AT&T Mobility.

(a) The City of Vienna, Missouri hereby approves, accepts, and adopts all terms and provisions of the Settlement Agreement as a binding and enforceable agreement between the City of Vienna, Missouri and AT&T Mobility, and as if the City of Vienna, Missouri was an original signatory thereto.

(b) The City of Vienna, Missouri further approves the Total Past Tax Consideration of $28,720.12 as shown on the U.S. Cellular Municipal Tax Settlement Claim Form, along with the other relief provided in the Settlement Agreement, as adequate consideration for the release of claims by the City of Vienna, Missouri against U.S. Cellular as provided for in the Settlement Agreement.

(c) The City of Vienna, Missouri further assigns to the Mo. Municipal League $1,436 of its Total Past Tax Consideration, which amount shall be used for the public purpose of reimbursing the League for revenues expended in its legislative and settlement efforts relating to the Lawsuit and to fund future services performed on behalf of the League’s member municipalities.

(d) The Mayor of the City of Vienna, Missouri, on behalf of the Plaintiff, is hereby authorized and directed to execute the U.S. Cellular Municipal Tax Settlement Claim Form and any other documents necessary under the Settlement Agreement.

(e) The City of Vienna, Missouri, reserves the right to conclude settlement agreements with other wireless telecommunications service providers in the Lawsuit depending upon the circumstances of each case. (Ord. 156, §§1-4)

Sec. 17-10. Approving a settlement agreement with Sprint.

(a) The City of Vienna, Missouri hereby approves, accepts, and adopts all terms and provisions of the Settlement Agreement as a binding and enforceable agreement between the City of Vienna, Missouri and Sprint, and as if the City of Vienna, Missouri was an original signatory thereto.

(b) The City of Vienna, Missouri further approves the Total Past Tax Consideration of $293.23 as shown on the U.S. Cellular Municipal Tax Settlement Claim Form, along with the other relief provided in the Settlement Agreement, as adequate consideration for the release of claims by the City of Vienna, Missouri against U.S. Cellular as provided for in the Settlement Agreement.

(c) The City of Vienna, Missouri further assigns to the Mo. Municipal League $14.66 of its Total Past Tax Consideration, which amount shall be used for the public purpose of reimbursing the League for revenues expended in its legislative and settlement efforts relating to the Lawsuit and to fund future services performed on behalf of the League’s member municipalities.

(d) The Mayor of the City of Vienna, Missouri, on behalf of the Plaintiff, is hereby authorized and directed to execute the U.S. Cellular Municipal Tax Settlement Claim Form and any other documents necessary under the Settlement Agreement.

(e) The City of Vienna, Missouri, reserves the right to conclude settlement agreements with other wireless telecommunications service providers in the Lawsuit depending upon the circumstances of each case. (Ord. 158, §§1-4)

ARTICLE II

MOTOR VEHICLE TAX

Sec. 17-11. Definitions.

Motor vehicle – The Term “motor vehicle”, as used in this Article, except where otherwise expressly provided, shall mean all vehicles propelled by any power other than muscular power, except traction engines, road rollers, fire extinguishing apparatus and engines, police patrol wagons, ambulances, road and street equipment owned or operated by this city or municipal corporations of this state, and such vehicles as run only upon rails or tracks.

Owner – The term “owner” shall include any person, firm, association, or corporation whose residence or domicile is within the city or whose residence is outside the city but whose motor vehicle is garaged or parked within the city for a period greater than thirty (30) days per annum.

Public highway – The term “public highway” shall include any highway, county road or public street, avenue, alley, parkway or public place in the city. (§341.001, 1978 Code)

Sec. 17-12. License required.

Every resident owner of a motor vehicle, which shall be garaged within the city or operated or driven upon the public highways of the city, or any motor vehicle garaged within the city and owned by a nonresident shall, if the board of aldermen require, obtain a city motor vehicle license at the office of the city collector, or other designated office, and on a blank furnished by the city collector, supply the following information:

(a) A brief description of the motor vehicle to be registered, including the name of the manufacturers, the motor number of such vehicle and the purpose and tonnage.

(b) The name, residence address and business address of the owner of such motor vehicle.

(c) If the motor vehicle be a commercial vehicle, the weight of the vehicle and its rated capacity of live load. (§341.003, 1978 Code; As amended by adopting ordinance dated July 7, 1992)

Sec. 17-13. License fees.

The registration fees for motor vehicles shall be remitted to the city collector, or other designated officer, with the application for registration and shall be in an amount established by the board of aldermen. (§341.005, 1978 Code; As amended by adopting ordinance dated July 7, 1992)

Sec. 17-14. Term of license – License fee pro-rated.

Registration of motor vehicles shall be renewed annually upon payment of the fees provided herein and after producing a tax receipt or a statement certified by the city collector, or other designated city officer, showing the full payment of the city personal and real property taxes for the preceding years or that no taxes were due. Said license shall be obtained on or before the first day of March of each year, and all certificates of registration and licenses issued hereunder shall expire on the succeeding twenty-eighth (28) or twenty-ninth (29) of February. If the application for registration of motor vehicle is made by an owner after the first of September of that year, only one-half (1/2) of the full annual fee shall be paid. (§341.019, 1978 Code)

Sec. 17-15. Collector to issue license.

Upon the issuance of a license for a motor vehicle, the city collector, or other designated officer, shall issue a transparent sticker license emblem, which license emblem shall bear the number of designating the year for which such license is issued and the license number assigned to such motor vehicle by said city. When said transparent sticker license emblem is delivered to any applicant for a motor vehicle license as herein provided, it shall be the duty of such applicant to affix the same in the lower right-hand corner on the inside of the glass part of the windshield of such motor vehicle, approximately one inch from the right and lower sections of the frame of such windshield. (§341.023, 1978 Code)

Sec. 17-16. Display of license.

Every motor vehicle shall be at all times while being used or operated on public highways in the city and when the owner thereof resides or is domiciled in the city or where the owner resides outside the city but garages or parks said motor vehicles within said city, shall have displayed conspicuously as herein provided, and kept reasonably clean, the transparent sticker issued by the city collector, or other designated city officer, as herein provided, bearing the number assigned to such vehicle by said city. (§341.025, 1978 Code)

Sec. 17-17. License not transferable.

City motor vehicle licenses shall not be transferable from one owner to another, and may only be used upon motor vehicles actually owned by the purchaser of said license. (§341.027, 1978 Code)

Sec. 17-18. Duplicate license.

In case of loss or destruction of a sticker or license emblem issued to any license, such licensee may obtain a duplicate sticker or emblem upon producing satisfactory proof thereof and the payment of a fee established by the board of aldermen to the city collector or other designated city officer. (§341.029, 1978 Code; As amended by adopting ordinance dated July 7, 1992)

Sec. 17-19. Penalty.

Any person, firm, association or corporation owning or operating a motor vehicle, truck, trailer, or semitrailer as described herein, who shall violate any provision of this Article, shall be deemed guilty of a misdemeanor, and upon conviction thereof shall be punished by a fine of not less than one nor more than one hundred dollars, or by imprisonment in jail not exceeding three months, or both such fine and imprisonment as may be just for any offense, recoverable with costs of suit. (§341.049, 1978 Code; As amended by adopting ordinance dated July 7, 1992)

Secs. 17-20 to 17-24. Reserved.

ARTICLE III

SALES TAX

Sec. 17-25. City sales tax.

That the City of Vienna, Missouri, impose a city sales tax the amount of which is to be determined by the board of aldermen in accordance with state law. (Ord. 4, §1; As amended by adopting ordinance dated July 7, 1992)

Sec. 17-26. Sales tax on residential utilities.

That the municipal sales and all sales of metered water service, electricity, electrical current, natural, artificial or propane gas, wood, coal or home heating oil … used for nonbusiness, noncommercial or nonindustrial purposes heretofore imposed within the city limits of municipality is hereby reimposed. (Ord. 4, §2)

Sec. 17-27. Tax rate.

That the rate of taxation shall be the amount of which is to be determined by the board of aldermen in accordance with state law. (Ord. 4, §3; As amended by adopting ordinance dated July 7, 1992)

Sec. 17-28. Clerk to provide copy of ordinance to utilities.

That the city clerk is hereby directed to provide copies of this Ordinance to all of the utilities which provide service within the corporate limits of the city, and to the director of revenue for the State of Missouri. (Ord. 4, §4)

Secs 17-29 to 17-33. Reserved.

ARTICLE IV

SALES TAX FOR TRANSPORTATION PURPOSES

Sec. 17-34. Imposition of city sales tax.

Pursuant to the authority granted by and subject to the provisions of Sections 94.700 to 94.755 RSMo., a tax for transportation purposes as defined in RSMo. 94.700 is hereby imposed upon all sellers for the privilege of engaging in the business of selling tangible personal property or rendering taxable services at retail to the extent and in the manner provided in Sections 144.010 to 144.510 RSMo., and the rules and regulations of the director of revenue issued pursuant thereto. The rate of the tax shall be determined by the board of aldermen in accordance with state law on the receipts from the sale at retail of all tangible personal property or taxable services at retail within Vienna, Missouri, if such property and taxable services are subject to taxation by the State of Missouri under the provisions of Sections 144.010 to 144.510, RSMo. The tax shall become effective as provided in Section 94.705 RSMo., and shall be collected pursuant to the provisions of Sections 94.700 to 94.755 RSMo. (Ord. 34, §1; As amended by adopting ordinance dated July 7, 1992)

Sec. 17-35. Ordinance submitted to voters.

This Ordinance shall be submitted to the qualified voters of Vienna, Missouri for their approval, as required by the provisions of Section 94.705 RSMo., at the general election hereby called and to be held in said city on Tuesday, the 8th day of November, 1988. The ballot title will be:

YES Shall there be a city transportation sales tax of (one-half of one percent) in the City of Vienna?

*See below

NO Ordinance No. 34 of Vienna, Missouri passed

September 8, 1988, imposing a city trans- portation sales tax at the rate of one-half of one percent (.005%) on the receipts from the sale at retail of all tangible personal property or taxable services at retail, subject to the sales tax imposed by the State of Missouri.

*The tax will be used for construction, reconstruction, repair and maintenance of streets within the city, or the acquisition of lands and rights-of-way for streets, and planning and feasibility studies for streets. The one-half cent sales tax shall be collected on the receipts from the sale at retail of all tangible personal property or taxable services at retail within the City of Vienna.

The voter who desires to vote in favor of said ordinance shall place a cross mark (x) in the square opposite the word “Yes.” The voter who desires to vote against said ordinance shall place a cross mark (x) in the square opposite the word “No.”

If a majority of the qualified voters voting at said election shall vote in favor of the approval of this ordinance, then the same shall be binding and in full force and effect. (Ord. 34, §2)

Sec. 17-36. Clerk to certify election results to director of revenue.

Within ten (10) days after the approval of this ordinance by the qualified voters of Vienna, Missouri, the city clerk shall forward to the director of revenue of the State of Missouri by United States registered mail or certified mail, a certified copy of this ordinance together with certifications of the election returns and accompanied by a map of the city clearly showing the boundaries thereof. (Ord. 34, §3)

Sec. 17-37. Severability clause.

If any section, subsection, sentence, clause, phrase or portion of this ordinance is for any reason held invalid or unconstitutional by any court of competent jurisdiction, such portion shall be deemed a separate, distinct and independent provision, and such holding shall not affect the validity of the remaining portions hereof. (Ord. 34, §4)

Secs. 17-38 to 17-42. Reserved.

ARTICLE V

LOCAL USE TAX

Sec. 17-43. Local use tax imposed.

Pursuant to the authority granted by and subject to the provisions of 144.757 et seq of the Revised Statutes of Missouri, a local use tax on out-of-state purchases is hereby imposed at the same rate as the local sales tax rate on all out-of-state purchases. (Ord. 78, §1)

Sec. 17-44. Local use tax based on sales tax.

If the local sales tax of the City of Vienna is repealed or the rate thereof is reduced or raised by voter approval, then the local use tax rate provided for herein shall also be deemed to be repealed, reduced or raised by the same action. (Ord. 78, §2)

Sec. 17-45. Use tax return.

A use tax return shall not be required to be filed by persons whose purchases from out-of-state vendors do not in total exceed two thousand dollars in any calendar year. (Ord. 78, §3)

Sec. 17-46. Clerk to certify ordinance to director or revenue.

The City Clerk shall forward a certified copy of this ordinance to the Director of Revenue of the State of Missouri together with any other necessary documentation including but not limited to certification of the election returns and a map of the City clearly showing the boundaries thereof and such other documents as may be required. (Ord. 78, §4)

Secs. 17-47 to 17-51. Reserved.

ARTICLE VI

SALES TAX FOR PUBLIC SAFETY

Sec. 17-52. City Sales Tax for Public Safety.

A citywide sales tax at a rate of one half (1/2) of one (1) percent for the purpose of improving the public safety of the city. (Ord. 218)

ARTICLE VII

TAX LEVY FOR ROAD DISTRICT #8

Sec. 17-53. Tax Levy for Road District #8

A General Revenue tax levy of 0.2475 on one hundred dollars valuation shall be assessed on all real property and all personal property within the corporate limits of the City of Vienna, Missouri. (Ord. 222; Ord. 231)